XRP Price Prediction: Will the Bullish Technicals Overcome Market Uncertainty?

#XRP

- XRP shows bullish technical signals trading above its 20-day MA with positive MACD crossover

- Regulatory uncertainty from SEC lawsuit and whale movements create downside risks

- Growing real-world adoption in healthcare and payments provides fundamental support

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

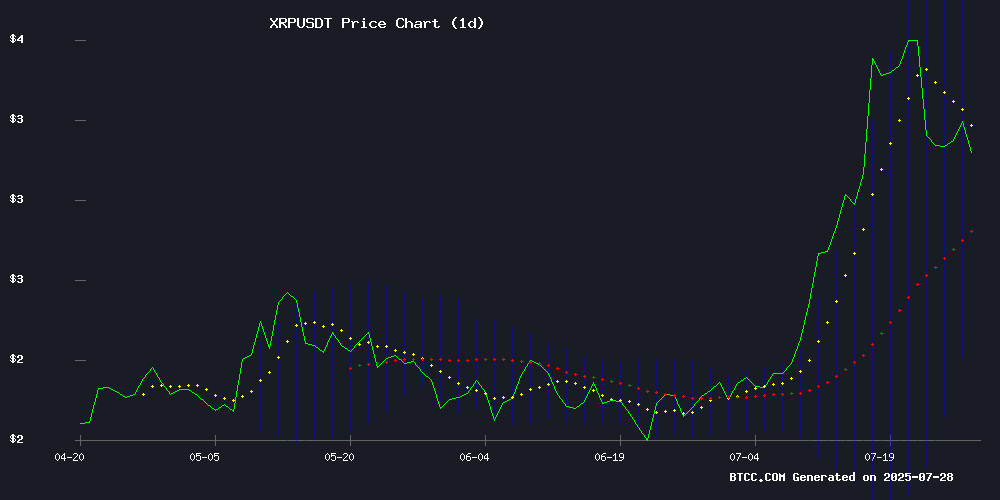

XRP is currently trading at $3.2702, above its 20-day moving average of $3.1097, indicating potential bullish momentum. The MACD shows a slight bullish crossover with a reading of 0.0658, though the overall MACD remains negative. Bollinger Bands suggest moderate volatility, with the price hovering NEAR the middle band. According to BTCC financial analyst Mia, 'The technical setup shows XRP could test resistance at $3.7613 if bullish momentum continues.'

Mixed Sentiment for XRP as Legal and Market Factors Weigh on Price

XRP faces headwinds from the ongoing Ripple-SEC legal battle, delaying ETF prospects and causing network activity to drop. However, developments like XRP Healthcare's public listing plans and Wellgistics Health's payment network adoption provide positive catalysts. BTCC analyst Mia notes, 'While legal uncertainty persists, real-world adoption continues to grow, creating a tug-of-war for XRP's price direction.'

Factors Influencing XRP's Price

Ripple-SEC Legal Standoff Delays XRP ETF Prospects as Appeals Process Unfolds

The prolonged legal battle between Ripple and the U.S. SEC continues to cast uncertainty over XRP's regulatory future. Speculation about a fourth closed-door SEC meeting on Ripple's appeal circulated widely before being debunked by former SEC attorney Marc Fagel. The case remains with the Court of Appeals as both parties contest different aspects of Judge Torres' ruling.

Market observers note the impasse directly impacts XRP's ETF eligibility. A resolution favoring Ripple could trigger explosive price action, while prolonged litigation may delay institutional adoption. The SEC's appeal challenges Torres' programmatic sales ruling, while Ripple contests the institutional sales classification.

XRP Network Activity Plummets Amid Price Decline

XRP faces mounting pressure as both network activity and price exhibit sharp declines. Active addresses on the XRP ledger dropped 44.2% in the week ending July 27, while the token's value fell nearly 11% to hover around $3.16.

The deterioration follows a brief surge in activity on July 20-21, when active addresses peaked at 44,143 before collapsing to 24,644. This volatility suggests weakening organic demand, with declining network participation potentially foreshadowing further price erosion.

Adding to downward momentum, Ripple co-founder Chris Larsen has moved approximately 50 million XRP to centralized exchanges since July 17. Such large-scale movements typically precede selling pressure, compounding concerns about near-term stability.

XRP Price Consolidates as Whales Pivot to 'XRP 2.0' Project Remittix

XRP retreated to $3.10 after a 30% weekly rally peaked at $3.66, with analysts viewing the 6% dip as routine profit-taking rather than a trend reversal. The pullback coincided with broader market softness following the SEC's delay of the Bitwise spot ETF and Bitcoin's struggle to hold $120K.

On-chain data reveals whales maintaining XRP accumulation while diversifying into emergent 'XRP 2.0' projects. Remittix, a cross-chain DeFi platform touted as an Ethereum alternative, has attracted $16.9 million in presale funding at $0.0842 per token. Its low-fee model and upcoming Q3 wallet beta have positioned it as a focal point for capital rotation.

Ripple Co-Founder's $140M XRP Transfer Triggers Market Dip as Cloud Mining Offers Hedge

XRP faced renewed volatility after Ripple co-founder Chris Larsen moved approximately $140 million worth of tokens to an exchange during a local price peak of $3.66. The subsequent 10% price drop within hours reignited debates about coordinated sell-offs among large holders.

Market sentiment soured as the transfer coincided with XRP's highest level since 2018. Such moves by foundational team members often test investor confidence in proof-of-stake assets where trust determines valuation.

RICH Miner capitalizes on the uncertainty by promoting cloud mining contracts as a volatility hedge. The platform claims to convert XRP holdings into fixed daily yields through computational power leases, though the sustainability of such models remains untested during prolonged bear markets.

XRP Healthcare Advances Toward Public Listing via Reverse Takeover

XRP Healthcare has taken a decisive step toward entering public markets by signing a Definitive Agreement with AAJ Capital 3 Corp. The reverse takeover (RTO) transaction will facilitate its listing on the TSX Venture Exchange, marking a pivotal moment in the company's expansion strategy.

The move underscores XRP Healthcare's commitment to governance and transparency as it seeks to align with capital markets standards. The RTO will position the company as the continuing entity post-transaction, enabling it to leverage public funding for growth.

With a CAD$1.78 million placement already in motion, XRP Healthcare aims to bolster its AI-driven health services across Africa. The public listing is not merely a capital-raising exercise but a strategic effort to enhance credibility and long-term market presence.

Wellgistics Health Adopts XRP and XRPL for Payment Network Innovation

Wellgistics Health, a Nasdaq-listed health-tech company, has formally outlined its strategic embrace of XRP and the XRP Ledger (XRPL) in an SEC filing. The S-1 submission details plans to leverage XRPL's infrastructure for real-time, low-cost B2B transactions across its pharmaceutical supply chain network.

The company will integrate XRP as a settlement asset between pharmacies, manufacturers, and vendors, while simultaneously expanding its treasury holdings of the cryptocurrency. Wellgistics intends to use XRP both as collateral for financing and as a yield-generating asset, signaling institutional confidence in the digital asset's utility.

Ripple CTO Rejects Forbes Article Defending SBF’s Criminal Conduct

Ripple Chief Technology Officer David Schwartz has publicly dismissed a Forbes article that sought to defend Sam Bankman-Fried's actions during his tenure at the now-defunct FTX exchange. The article argued that Bankman-Fried's lobbying efforts for crypto regulation should mitigate his culpability in the misuse of customer funds. Schwartz categorically rejected this argument, stating that regulatory advocacy cannot excuse criminal financial misconduct.

The Forbes piece portrayed Bankman-Fried as a champion of crypto industry interests, but Schwartz countered this narrative as dangerously misleading. He emphasized that the jury's verdict finding Bankman-Fried guilty of fraud was justified, regardless of his regulatory efforts. Financial laws exist precisely to prevent the unauthorized use of customer assets, Schwartz noted, and innovation must operate within these legal boundaries.

This rebuke comes as the crypto industry continues grappling with its regulatory future. While some advocate for more flexible frameworks to accommodate innovation, Schwartz's comments reinforce that existing financial laws still apply. The case serves as a stark reminder that even in crypto's disruptive ecosystem, traditional standards of financial integrity remain paramount.

Ripplecoin Mining Launches XRP Cloud Mining Contracts Amid Market Volatility

XRP faced significant market turbulence with over $88.58 million in liquidations within 24 hours, according to CoinGlass data. The asset's volatility highlights the challenges in the current crypto landscape, where sudden price swings are testing investor resilience.

Ripplecoin Mining responded by introducing XRP cloud mining contracts, leveraging AI-driven computing power to offer stable daily returns. The platform positions this as a solution for holders seeking consistent income streams despite market fluctuations.

XRP's institutional appeal—rooted in fast transaction speeds and low fees for cross-border payments—continues to drive adoption. Ripplecoin Mining's new service capitalizes on this demand by enabling direct participation in computing power contracts, effectively creating a 'hold-to-earn' model for XRP investors.

Is XRP a good investment?

XRP presents a mixed investment case currently. On the technical side, the price is showing bullish signals trading above its 20-day MA with a positive MACD crossover. However, the ongoing SEC lawsuit and whale movements to alternative projects like Remittix create uncertainty.

| Metric | Value | Implication |

|---|---|---|

| Current Price | $3.2702 | Above 20-day MA ($3.1097) |

| MACD | 0.0658 | Bullish crossover |

| Bollinger Bands | $2.4581-$3.7613 | Moderate volatility |

As BTCC analyst Mia suggests, 'Investors should weigh the strong technical setup against the regulatory risks, with potential upside to $3.76 if bulls maintain control.'

1